Summary

Why Integrated Resale Is the Next Growth Lever in Textiles

The fashion and textile industry is at a turning point. For years, sustainability was treated as an add-on or a marketing slogan. Today, it has become a business imperative. Consumers are demanding circular solutions that reduce waste and protect the planet. At the same time, regulators across the US and Europe are tightening the rules: from extended producer responsibility laws to textile waste targets. Brands that fail to act risk losing relevance, market share, and customer trust.

Against this backdrop, one opportunity is rising faster than most: resale. Once seen as niche, the secondhand apparel market is now a global force. Analysts forecast that secondhand fashion will grow to $367 billion globally by 2029, expanding at an impressive 10% compound annual growth rate. In the US alone, the market is expected to nearly double within five years. Europe is on a similar trajectory, driven by consumer demand and supportive policy frameworks.

But there’s more to this trend than numbers. Resale is no longer just about consumers swapping clothes on third-party platforms. The real growth lever for brands lies in integrated resale, also known as branded resale: when fashion companies themselves take ownership of the secondhand market for their products. This approach allows brands to:

- Capture new revenue streams by monetizing products multiple times.

- Build stronger customer relationships, offering more touchpoints and driving loyalty.

- Deliver measurable sustainability impact by keeping garments in use and cutting CO₂ emissions.

Integrated resale represents a rare win-win: it helps companies future-proof their business, respond to customer values, and make sustainability profitable. For textile brands ready to lead rather than follow, the opportunity has never been clearer.

What Is Integrated Resale for Textiles?

Integrated resale means a brand takes an active role in the resale of its own products. Instead of leaving secondhand sales entirely to external marketplaces, the company either directly manages or facilitates the resale process. This can happen through a brand’s own online shop for pre-owned items, a trade-in program where customers return used products for credit, or a peer-to-peer platform hosted by the brand.

This approach is different from traditional third-party resale, where consumers sell used clothing independently on platforms like Poshmark, Depop, or eBay. In those cases, the brand has no involvement, no visibility into what happens to its products, and no share in the value created by secondhand sales. Integrated resale, by contrast, keeps the brand at the center of the transaction.

For businesses, the advantages of integrated resale are significant. Brands that own or facilitate their resale channels can:

- Retain more margin, since they control pricing and avoid external commission costs.

- Capture valuable customer data, gaining insights into buying, usage, and trade-in behaviors.

- Protect and reinforce brand perception by ensuring pre-owned items meet quality standards.

- Own their secondary market, preventing others from capitalizing on the value of their products.

By integrating resale, fashion brands not only extend the life of their textiles but also strengthen their business model, positioning themselves as leaders in both innovation and sustainability.

The Market Potential: Secondhand Textiles Go Mainstream

Secondhand fashion is no longer a fringe trend. It has evolved into a major force reshaping the textile and apparel industry in both the US and Europe. Resale is not only growing faster than traditional retail — it is capturing a larger share of consumers’ wardrobes and spending with every passing year.

In the United States, the secondhand apparel market is projected to grow from about $39 billion in 2022 to $74 billion by 2029, with online resale expected to nearly double in that period. The growth rate consistently outpaces new apparel sales by a wide margin. Europe follows a similar path. A 2025 study by the Circular Fashion Federation and KPMG predicts that the European resale market will expand from €15.9 billion in 2024 to around €26 billion by 2030, driven by both consumer demand and regulatory support.

This shift isn’t just about the size of the market. It’s about how consumers are changing their buying habits. Younger generations, in particular, are leading the way:

- Gen Z and Millennials plan to allocate up to 46% of their clothing spend to secondhand items in the coming years. For many, buying used is no longer an occasional choice; it’s becoming their default way to shop (ThredUp Resale Report).

- Across all age groups, more than 70% of consumers say they are open to buying pre-owned apparel. Resale has entered the mainstream and carries little of the stigma it once had.

94% of retail executives say their customers already participate in resale, often through third-party platforms. If brands don’t offer their own resale solutions, they risk losing touch with these customers and leaving value on the table.

Integrated resale offers textile brands the chance to meet shoppers where they are — in the thriving secondhand market while keeping control over quality, pricing, and the customer relationship.

Who’s Doing It? Brand Examples Leading the Way

Integrated resale is no longer experimental. Across outdoor gear, denim, fast fashion, and luxury, brands are proving that take-back and resale programs can work at scale. These leaders show how different segments of the textile industry are turning circularity into business opportunity.

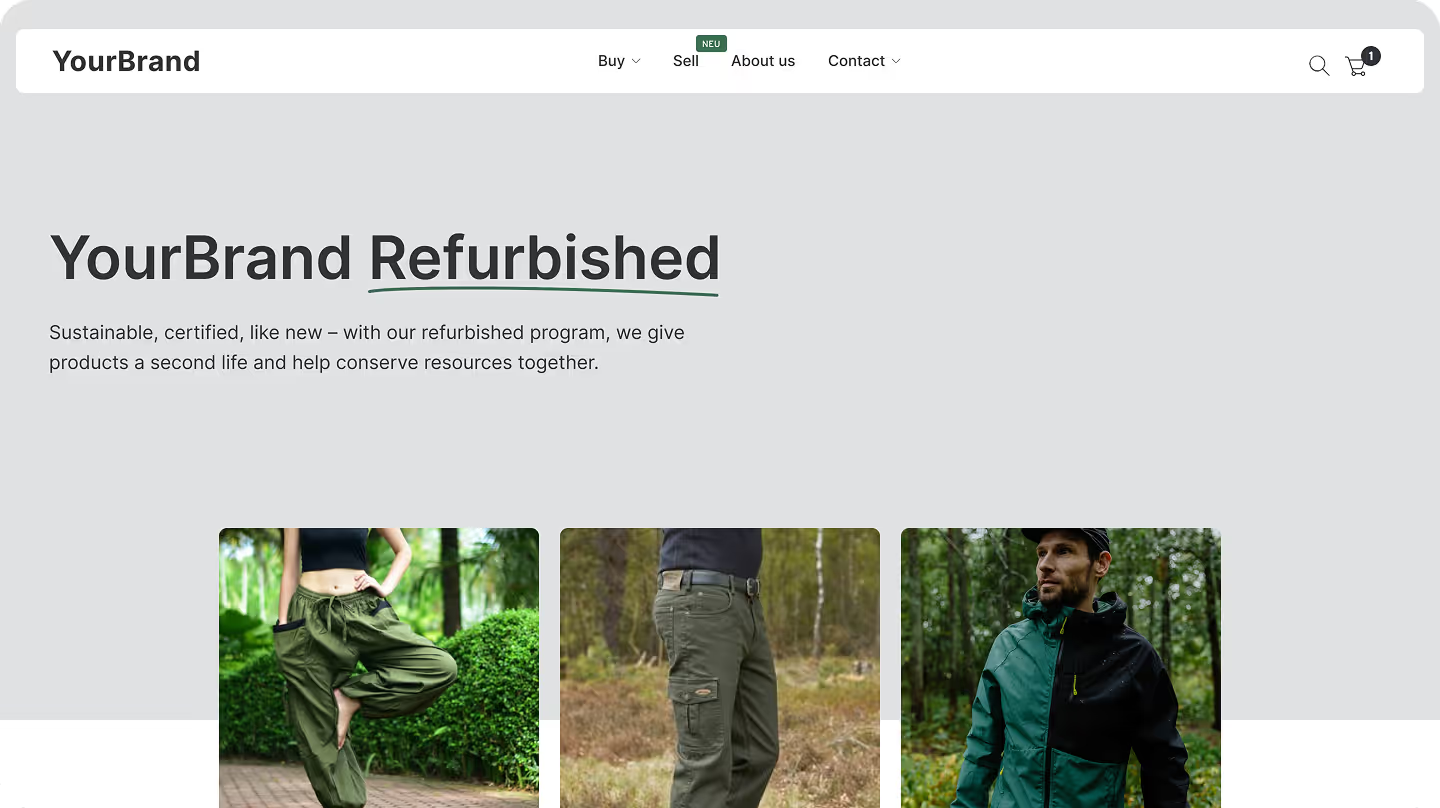

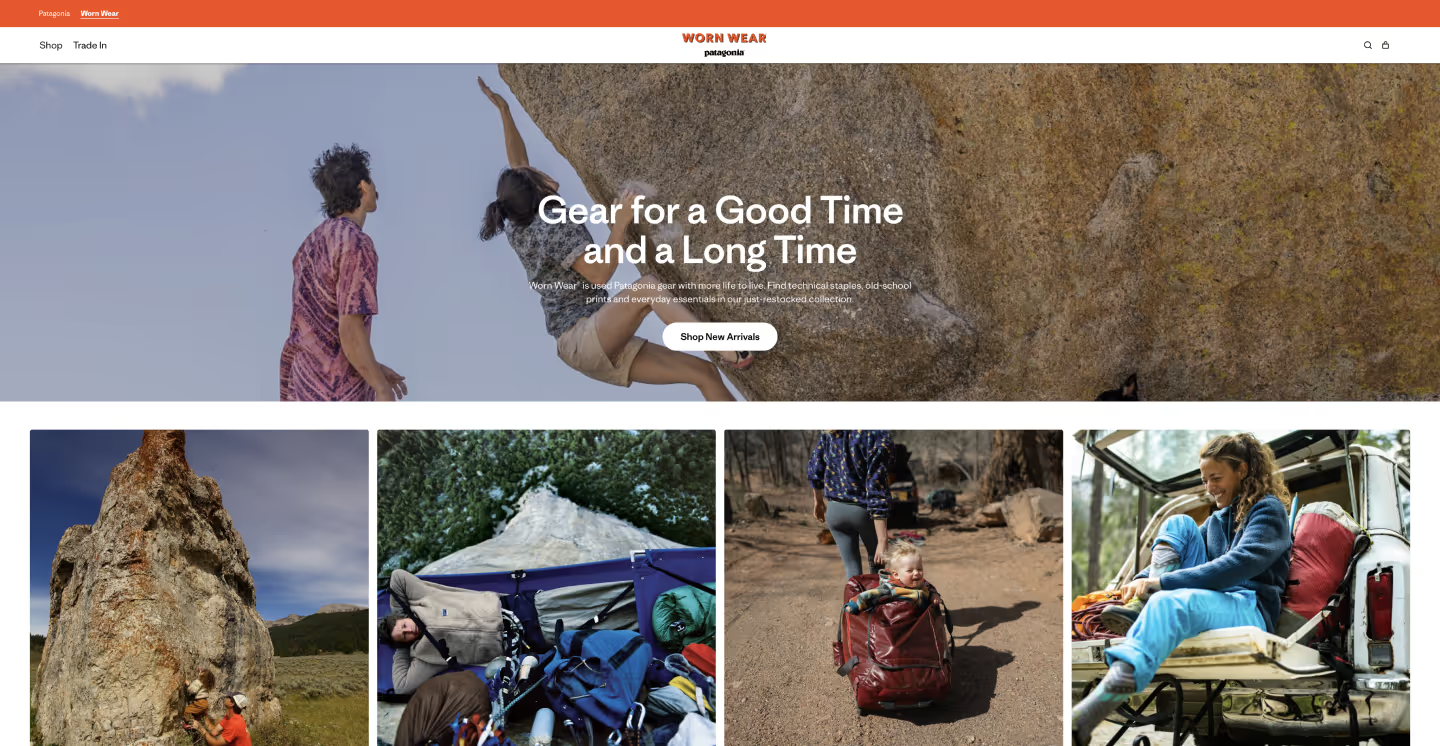

- Patagonia is widely seen as a pioneer in this space. Its Worn Wear program has been running for more than a decade, offering customers the chance to trade in used gear for store credit. Patagonia inspects, repairs, and resells these items on its dedicated Worn Wear platform. The result is a powerful combination of revenue, customer loyalty, and environmental impact.

- Another strong example is The North Face, whose Renewed program has expanded significantly in recent years. The North Face allows customers to return used apparel for credit, then professionally refurbishes and sells these products through its official channels. This initiative helps the brand serve value-conscious shoppers and reduce waste from outdoor gear that’s built to last.

- In the denim category, Levi’s SecondHand shows how heritage brands can reclaim value in the booming vintage market. Customers can trade in old Levi’s jeans and jackets in exchange for credit, and Levi’s resells these iconic pieces on its own resale platform. The approach not only captures revenue but strengthens the brand’s sustainability credentials.

- European brands are stepping up as well. COS, part of H&M Group, launched COS Resell, a peer-to-peer platform where customers can buy and sell pre-owned COS garments directly. Zara introduced a resale and repair service in the UK, signaling even fast-fashion giants see resale as essential for future competitiveness.

- Luxury is embracing resale too. Balenciaga enables customers to return pre-owned items for store credit. These pieces are authenticated and resold via a network of premium secondhand marketplaces. This model helps Balenciaga maintain control over how its products appear in the secondary market while offering clients an easy way to participate in circular fashion.

Other notable players include:

- Lululemon with its Like New trade-in and resale program for athletic wear

- REI, combining trade-ins, online used gear sales, and in-store garage sales

- Eileen Fisher Renew, one of the longest-running branded resale programs

- Madewell Forever, blending trade-in incentives with online resale

Together, these brands demonstrate that integrated resale works across categories — from fast fashion to luxury, outdoor gear to denim. What they have in common is a strategy that connects business growth with circularity, proving that resale is a serious tool for revenue, customer retention, and sustainability.

The Business Case: Resale as a Revenue and Loyalty Driver

Integrated resale is far more than a sustainability initiative. It is proving to be a serious business driver for textile and fashion brands.

At the core of the business case is the simple fact that resale enables multiple monetizations of a single item. Instead of profiting only at the initial sale, a brand can earn revenue again and again as that product finds new owners. Patagonia, for example, has sold over 120,000 pre-owned garments through its Worn Wear program, generating incremental sales from items that would otherwise have no further value for the company. Similarly, Levi’s and Lululemon resell returned items at substantial margins, given the low cost of acquiring used goods (typically just the value of store credit provided in exchange).

Integrated resale is also a powerful tool for customer acquisition. Many resale shoppers are new to the brands they buy secondhand. Industry data shows that about 50% of customers purchasing pre-owned items on branded resale sites are new to the brand, making resale a valuable entry point for consumers who may have been priced out of buying new. By offering quality pre-owned products at more accessible price points, brands can grow their audience while showcasing their durability and style.

Beyond acquisition, resale programs foster repeat business and loyalty. When customers trade in items for credit, they are highly likely to spend it on new or used products within the same brand ecosystem. In fact, studies report that 84% of sellers choose store credit over cash payouts. This not only drives immediate follow-up purchases but deepens the customer relationship by creating more brand touchpoints over time.

Finally, integrated resale helps build community and brand love, especially among younger shoppers. Gen Z and Millennials see circularity as part of a brand’s identity. They want to support companies that make it easy to shop sustainably and responsibly. Resale programs give these consumers a reason to engage, share their finds, and identify with the brand’s values. In a market where trust and authenticity drive loyalty, resale offers brands a way to stand out and create lasting connections.

In short, integrated resale allows brands to do what many businesses struggle with: generate more revenue, attract and retain customers, and align profit with purpose.

The Sustainability Win: Real Impact Beyond Marketing

Integrated resale doesn’t just tell a good story… it delivers measurable environmental benefits. By keeping products in use longer, brands can significantly reduce their carbon footprint. Buying a used item instead of new cuts its CO₂ impact by around 25% on average. For brands that scale resale programs, the potential is even greater: some studies estimate a 15% reduction in annual carbon emissions by 2040.

Resale also tackles the growing problem of textile waste. Programs like Eileen Fisher Renew and J.Crew’s take-back partnerships have already diverted millions of garments from landfill. Each item resold means fewer resources wasted and less pollution generated.

The water and resource savings are equally striking. Denim and cotton-heavy products, in particular, have high water footprints when made new. Every secondhand pair of jeans sold saves hundreds of gallons of water, a powerful contribution in a resource-constrained world.

How to Start: Tech Partners Powering Resale Programs

Launching a resale program is easier than ever with the right partner. koorvi offers brands a complete solution to set up and manage integrated resale — from trade-in systems to refurbishment tracking and online shop management. Whether you want a peer-to-peer model or to control inventory and quality yourself, koorvi’s software adapts to your needs.

Beyond technology, success in resale relies on getting logistics, cleaning, and data right. koorvi helps brands manage the full process: from intake and grading to customer communications and secondary sales analytics. The result? A smooth, profitable circular program that strengthens customer loyalty and protects the planet.

Integrated Resale – From Nice-to-Have to Must-Have

Integrated resale has moved beyond being a nice idea. It is now a strategic must for textile and fashion brands that want to stay competitive, relevant, and responsible. The opportunity is clear: resale opens up new revenue streams, creates more customer touchpoints, and delivers real sustainability impact by keeping products in use and out of landfills.

With consumers demanding circular solutions and the market for secondhand textiles growing faster than ever, the time to act is now. If you want to own your secondary market and double your product’s profit, now is the time to act.

At koorvi, we make it easy for brands to launch and manage integrated resale programs. From trade-in systems to refurbishment tracking and online resale shops, we help you turn sustainability into profit while building stronger customer relationships.